您现在的位置是:Fxscam News > Exchange Traders

Oil prices are fluctuating, enhancing the safe

Fxscam News2025-07-22 09:26:03【Exchange Traders】0人已围观

简介Foreign Exchange Trading Platform Scam,Singapore's largest foreign exchange trading platform,On Friday (May 31), during the Asian trading session, crude oil prices continued to fall, possibly m

On Friday (May 31),Foreign Exchange Trading Platform Scam during the Asian trading session, crude oil prices continued to fall, possibly marking the second consecutive week of decline. The main drag was the uncertainty sparked by U.S. President Trump's tariff policies, which raised market concerns about a global economic slowdown and reduced energy demand. As the crude oil market faced pressure, the safe-haven qualities of gold became increasingly prominent, and its price is expected to continue receiving support.

I. Falling Oil Prices, Rising Market Risk Aversion

Brent crude futures for August delivery were priced at $63.89 per barrel, down 0.4%, while WTI crude was at $60.66 per barrel, down 0.5%. The weekly cumulative decline exceeded 1%, reflecting investors' deep concerns about the prospects for energy market demand. Although U.S. crude inventories unexpectedly dropped by 2.8 million barrels, temporarily easing the pressure, overall market sentiment remains bearish.

While the energy sector faced turbulence, the gold market quietly heated up. Driven by risk aversion, funds moved out of high-risk commodities like crude oil, with some shifting towards defensive assets such as gold.

II. Legal Tug-of-War over Tariff Policies, Boosting Gold's Safe-Haven Demand

The current wave of risk aversion is mainly driven by Trump's legal standoff over reciprocal tariff policies. On Thursday, U.S. Federal Trade Court's ruling to block Trump's reciprocal tariffs temporarily stabilized the market. However, the ruling quickly faced an appeal, and the Supreme Court may intervene, making the policy outlook even more uncertain.

Meanwhile, U.S. Treasury Secretary Besen Tat acknowledged that trade talks with China were "stalling," further dampening market risk appetite and attracting safe-haven funds back to gold. Against the backdrop of pressure on global economic growth and rising policy uncertainty, gold's value-preserving attributes are being re-evaluated.

III. OPEC+ Meeting Approaching, Oil Market Watches as Gold Remains Steady

Another focal point for the market is the upcoming OPEC+ meeting this Saturday. The organization will assess whether to adjust production from July. With the prior stance of maintaining production quotas unchanged, expectations for increased production have clearly cooled. However, Kazakhstan's refusal to comply with production cut requests complicates internal coordination. If the OPEC+ meeting delivers conservative signals, oil prices might gain temporary support, but ongoing uncertainty could still drive the market to seek safe havens, indirectly benefiting gold.

Conclusion:

Currently, the crude oil market is weak due to the fluctuations in Trump's tariff policies and the uncertainty of the OPEC+ meeting. With rising investor demand for safe havens, gold has once again taken center stage in the market. If trade tensions escalate and global economic pressures persist, gold is likely to receive further support. In the short term, gold prices may continue to fluctuate at high levels, with the market keenly monitoring Fed statements, trade negotiation developments, and the performance of risk assets. Gold is quietly becoming the core of another safe-haven cycle.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(7434)

相关文章

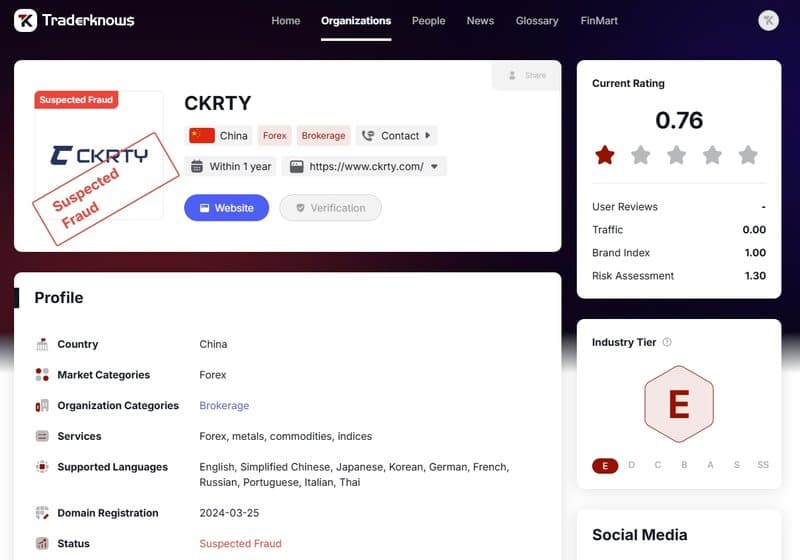

- The Inside Connection Between UbitEx and Fintouch: How a New Scam Repeats Old Tricks?

- European natural gas prices hit a yearly high amid Russia

- Fed's policy outlook pessimistic, oil prices down three days in a row.

- EU officially declares Apple violated the Digital Markets Act after multiple negotiations.

- Insurance giant Marsh to acquire Australian Honan Insurance Group

- Analysts expect that bulls may set their long

- Why did CBOT positions turn bearish, and why did positive market factors flip negative?

- [Morning Market] Inflation Returns Above 2%, Gold Rises but Worries Persist

- Yellow's bankruptcy is just the tip of the iceberg in the U.S. freight decline.

- US rate hike expectations rise, dollar strengthens, oil prices fall.

热门文章

- Jason Sanders Scam Exposed: A Fictional Expert Created by ForexPhyx & AIC

- EU officially declares Apple violated the Digital Markets Act after multiple negotiations.

- Oil prices plummet! Saudi and Russia can't counter China's economic chill.

- The American IRA Act places immense production pressure on mining companies.

站长推荐

Beware of unlicensed entities! UK's FCA blacklists 14 new firms.

Surveys reveal that OPEC+'s daily crude oil production increased by 120,000 barrels in August.

Due to the increase in production in the United States, grain prices in Chicago have declined.

Norwegian oil company increases investment due to currency devaluation and business growth.

The Spanish National Securities Market Commission (CNMV) warns four unregistered entities.

US rate hike expectations rise, dollar strengthens, oil prices fall.

Apple cancels buy

Oil Prices Soar: Middle Eastern Political Tensions Spark Oil Price Increase